A strong yarn for clothing GST is predicted to reduce margins due to high input costs

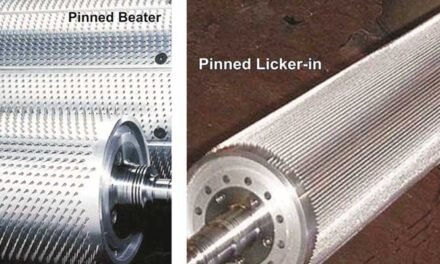

The implementation of Goods and Services Tax (GST) on strong yarn, a critical input for the clothing manufacturing industry, is anticipated to negatively impact profit margins for businesses within this sector. This is primarily attributed to a significant increase in input costs. Strong yarn, characterized by its durability and strength, is essential for producing high-quality garments, particularly those made from natural fibers like cotton. The imposition of GST on this input material directly translates to higher production expenses for manufacturers.

This escalation in input costs can pose a significant challenge to the competitiveness of Indian textile and apparel manufacturers, especially in the global market. If competing businesses in other regions or countries do not face similar GST levies on their inputs, Indian manufacturers may find themselves at a disadvantage in terms of pricing and overall competitiveness. This disparity in input costs could potentially lead to a reduction in export competitiveness and a decline in market share for Indian-made clothing.

Furthermore, the ability of businesses to pass on these increased costs to consumers through higher selling prices may be limited. In a highly competitive market where consumers are often price-sensitive, significant price increases could deter customers and negatively impact sales volumes. This limitation in passing on costs directly impacts profit margins, potentially squeezing them for businesses operating within the textile and apparel industry.

The impact of GST on strong yarn is particularly concerning for Small and Medium Enterprises (SMEs) within the textile sector. These businesses, often operating on relatively thin margins, may be more vulnerable to the effects of increased input costs. Their limited financial resources and smaller scale of operations may hinder their ability to absorb these additional expenses, potentially impacting their profitability and even their long-term viability.

The imposition of GST on strong yarn used in clothing manufacturing is expected to have a significant impact on the profitability of businesses within the textile and apparel industry. The increase in input costs, coupled with potential limitations in passing on these costs to consumers, could lead to reduced profit margins and increased competitive pressures. This is particularly concerning for SMEs within the sector, which may face greater challenges in adapting to these changes.